Small Business

Meeting Calls

Watch this page for information on Small Businesses and Small Business owners.

CFBPW Small Business Chair: Manjul Batra manjulm@aol.com or manjulbatra1@gmail.com or (510) 612-4934.

Are you a NFBPWC member and do you own a business? You can add your business to the NFBPWC Member Business Directory by following the steps detailed here: https://nfbpwc.org/Business-Directory-Submission-Form. If you are a member of CFBPW, you can add your business to this page by sending your information to lindalwilson@juno.com .

Members who have small businesses are invited to promote their businesses on this page.

Burbank BPW member Muskan Lalwani encourages members to check out her business Gifts Infinity http://www.giftsinfinity.com

Burbank BPW member Muskan Lalwani encourages members to check out her business Gifts Infinity http://www.giftsinfinity.com

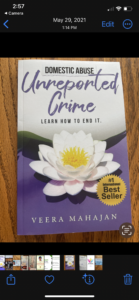

Burbank BPW member Veera Mahajan entitled “Unreported Crime: Learn How to Report it” on reporting domestic abuse. The cost of the book is $10. Contact her at veeraisit@gmail.com

Burbank BPW member Veera Mahajan entitled “Unreported Crime: Learn How to Report it” on reporting domestic abuse. The cost of the book is $10. Contact her at veeraisit@gmail.com

Betty Allums’ business GENIUS THINKLINK has the thrust of motivating people toward knowing that they have gen8us abilities. Knowing one’s strong abilities gives the confidence to move toward significant goals, which creates a purpose for living. Betty’s business is designed to identify and develop a person’s genius.

We measure 26 thinking abilities and provide strategies for developing priority abilities. Our three-hour assessment of Cognitive, Memory, Evaluation,/decision making and Problem-Solving Abilities is followed up by result explanation and a plan according to one’s priorities. Education Therapy can be scheduled or workshops self-paced materials such as THINKPAKS, workbooks, Challenging Events. We are available by appointment at 3575 San Pablo Dam Road, El Sobrante CA 94803. Phone (510) 938 0232.

Alia Ismail, member of Burbank BPW, is a financial planner. “My goal is to be realistic and honest with what I think a client may or may not achieve. I support my clients during market volatility and help them have the courage and clarity to take the most appropriate investment decisions. I am open to serving any client that needs guidance. However, my ideal clients live in the Santa Monica-Malibu area, and are investors interested in sustaining and reasonably growing their wealth, while building an authentic, long-term relationship with a trusted advisor. My primary focus is preparing my clients against the unexpected. My background comprises roles at other financial services firms, among which are American Express Financial Advisors, TD Waterhouse and Ameriprise Financial. Besides holding an MBA, I hold a Master of Dispute Resolution, as well as the Series 7, Series 66 and Life licenses.” Her office is at 530 Wilshire Blvd., Ste.204, Santa Monica, CA 90401. Phone: (310) 394-4001. Office hours are Monday-Friday 9:00 A.M.-6:00 P.M. and Saturday 9:00 A.M.-3:00 P.M. Website https://www.edwardjones.com/us-en/financial-advisor/alia-ismail.

Alia Ismail, member of Burbank BPW, is a financial planner. “My goal is to be realistic and honest with what I think a client may or may not achieve. I support my clients during market volatility and help them have the courage and clarity to take the most appropriate investment decisions. I am open to serving any client that needs guidance. However, my ideal clients live in the Santa Monica-Malibu area, and are investors interested in sustaining and reasonably growing their wealth, while building an authentic, long-term relationship with a trusted advisor. My primary focus is preparing my clients against the unexpected. My background comprises roles at other financial services firms, among which are American Express Financial Advisors, TD Waterhouse and Ameriprise Financial. Besides holding an MBA, I hold a Master of Dispute Resolution, as well as the Series 7, Series 66 and Life licenses.” Her office is at 530 Wilshire Blvd., Ste.204, Santa Monica, CA 90401. Phone: (310) 394-4001. Office hours are Monday-Friday 9:00 A.M.-6:00 P.M. and Saturday 9:00 A.M.-3:00 P.M. Website https://www.edwardjones.com/us-en/financial-advisor/alia-ismail.

Michelle Husby, member of Berkeley BPW, is selling Melaleuca Products (melaleuca.com). Melaleuca introduces a new world of naturally effective, one-of-a-kind wellness products to you, your home, and your family. With more than 400 unique products to choose from, shopping with Melaleuca is always filled with variety and options. This is a MLM business, so she is also looking for people who want their own business – or just to be able to purchase directly from the company each month. Michelle.Husby@gmail.com or 510.222.7254 (landline).

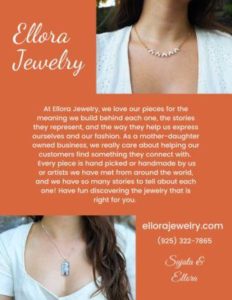

Ellora Easton, member of Berkeley BPW, has a jewelry business – see her flyer below.

Ellora’s website is ellorajewelry.com. The phone number for more information is (925) 322-7865

The National Federation of Business and Professional Women’s Clubs (NFBPWC) also offers training that will benefit small businesses and their employees. For additional NFBPWC resources, including member-only business training videos, please visit the Entrepreneur & Business Owner Program page on the NFBPWC website. See also https://www.nfbpwc.org/Lifelong-Leadership-Learning for information on the Lifelong Leadership and Learning Program.

See what the U.S. Dept of Treasury can do for your Business!

Small Business Programs

STATE SMALL BUSINESS CREDIT INITIATIVE (SSBCI)

SSBCI supports state programs that, in turn, use the funds to support private sector loans and investments to small businesses and small manufacturers that are creditworthy but are not able to access the capital they need to expand and create jobs.

SMALL BUSINESS LENDING FUND (SBLF)

The Small Business Lending Fund (SBLF) provided capital to qualified community banks and community development loan funds (CDLFs) to encourage these institutions and Main Street businesses to work together to promote economic growth and create new jobs. Through the SBLF program, Treasury invested over $4.0 billion in 332 institutions, structured to incentivize increased small business lending.

COMMUNITY DEVELOPMENT FINANCIAL INSTITUTIONS FUND (CDFI FUND)

The CDFI Fund promotes economic revitalization and community development in low-income communities through investment in and assistance to mission-driven lenders known as Community Development Financial Institutions (CDFIs) and other community development organizations. The CDFI Fund accomplishes this goal through the Community Development Financial Institutions Program, the New Markets Tax Credit Program, the CDFI Bond Guarantee Program, the Bank Enterprise Award Program and the Native American CDFI Assistance Program.

OFFICE OF SMALL AND DISADVANTAGED BUSINESS UTILIZATION

The Office of Small and Disadvantaged Business Utilization assists, counsels, and advises small businesses of all types (small businesses, small disadvantaged business, women-owned small businesses, economically disadvantaged women-owned small businesses, veteran owned small businesses, service disabled veteran owned small businesses, and small businesses located in historically underutilized business zones) on procedures for contracting with Treasury.

Assistance for Small Businesses

SMALL BUSINESS TAX CREDIT PROGRAMS

The American Rescue Plan extends a number of critical tax benefits, particularly the Employee Retention Credit and Paid Leave Credit, to small businesses.

EMERGENCY CAPITAL INVESTMENT PROGRAM

The Emergency Capital Investment Programs support the efforts of low- and moderate-income community financial institutions.

PAYCHECK PROTECTION PROGRAM

The Paycheck Protection Program is providing small businesses with the resources they need to maintain their payroll, hire back employees who may have been laid off, and cover applicable overhead.

NFBPWC and CFBPW Small Business Committee held a “Small Business Forum on Monday, August 23rd. Participants told how they started their businesses including finding funding. They also credited the help that they received from other members of NFBPWC. Future forums are planned, but the dates and topics are not yet set. NFBPWC/CFBPW Small Business Chair: Manjul Batra manjulm@aol.com or manjulbatra1@gmail.com or (510) 612-4934.

|

NFBPWC/CFBPW Small Business Chair Manjul |

NFBPWC President Megan, who does business consulting |

NFBPWC 2nd Vice President Daneene, who is in the insurance business |

|

Past BPW International President Liz, who was in international trade and is an inventor |

Past CFBPW President Bessie, who owns Latitudes Signs and Banners |

Past CFBPW President Katherine, who is a certified meeting professional and association administrator |

|

President Emerita NYC/BPW Francesca, who is a commuinication, strategist, catalyst and author |

President Berkeley BPW Maria, who is an attorney and a clinical laboratory consultant |

Guest speaker Michele Molitor, founder and CEO of Nectar Consulting |

|

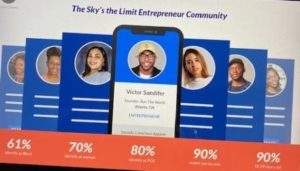

Berkeley BPW Student Member Ellora, who is with the non-profit “Sky Is The Limit” |

Slide from Ellora’s PowerPoint showing the work that needs to be done to help women and minorities start businesses |

Participants in the Forum |